We came very close to a market accident last week...

and the Fed doesn't have another script prepared... Low yield is the foundation of today's boom, and when it's questioned, liquidity risks are exposed. The exit has become too difficult for the Fed...

What went down with the market sell-off last week?

Last week, yields on U.S. government debt rose to the highest level since Covid happened and surged past a set of inflection points – triggering a brutal market sell-off that led to the NASDAQ declining a week in a row. Investors started to discuss whether this is a potential sign for the global speculative euphoria coming to an end.

(Well, they’ve been discussing that for a while without getting anywhere, and this event didn’t really change too much, so we’re probably not even close to ending this “young bull run”…)

What happened was: because there’s so much optimism about vaccination progress, stimulus package passing, and positive economic data in general, the markets have gradually started to price in the possibility that the Federal Reserve will gradually start to raise interset rates as early as 2023. I wrote two weeks ago that we might even see the Fed raising rates and tightening much earlier than that.

As a result, yields started moving up consistently in October, which started with them under 0.7%. Yields eventually took off with startling speed on Thursday, as summarized by Bloomberg:

The rate on 10-year Treasuries — which strips out inflation and is seen as a pure read on growth prospects — reached 1.61% at one point, the highest in a year.

In a telltale warning sign for some strategists, the 5-year Treasury yield soared convincingly above 0.75%, a crucial level that was expected to exacerbate selling, as traders pulled forward bets on when the Federal Reserve will start lifting policy rates.

The Treasury’s 7-year note auction on Thursday 2/25 exacerbated the yield rise after demand at the auction cratered.

The 10-yr yield reflects expectations about economic growth and inflation over the medium run, so many contracts and valuations for equities use it for discounting purposes. When yields rise, the equities (at least some) tumbled:

We came very close to a market accident last Thursday…

After last Thursday’s Treasury auction that caused the yield surge, Mohamed El-Erian, chief economic adviser at Allianz, the corporate parent of PIMCO where he was CEO and co-chief investment officer (CIO), went on Bloomberg on Friday 2/26 to talk about “how close we got to a market accident this week, liquidity risk and market structure, and the different reaction functions of central banks.”

This is what El-Erian said (transcript slightly reworded by me for clarity), which I think is worth reading/watching:

The most important risks that I’ve been talking about: market accident or disruptive yield curve dynamic. Yesterday we had disruptive yield curve dynamics following the Treasury auction, and we came very close to a market accident.

In pursuing genuine economic objectives, the Fed provided liquidity – which is the foundation for the whole building. And we kept on building more based on this liquidity foundation: Bitcoin, GameStop, SPACs… The foundation for all this is low yield; and if people start questioning that foundation, we’ll realize that the system has just taken on not too much interest rate or credit risks, but in fact liquidity risks.

That is very dangerous. It happened in the context of Robinhood in January, and we saw it again yesterday. In two months, we came close twice to a market accident.

When people woke up in the morning and realized that the yield curve made no sense, that’s when things started to go down. The somewhat good news is that the market has been self-correcting, and we didn’t see a big crisis.

The Fed doesn’t have another script to tell right now…

With all the market volatility last week, the Fed didn’t do much, or anything for that matter. Every Fed member reiterated their commitment to the current policy framework and their optimistic outlook on the economy. Everyone sticked to the script.

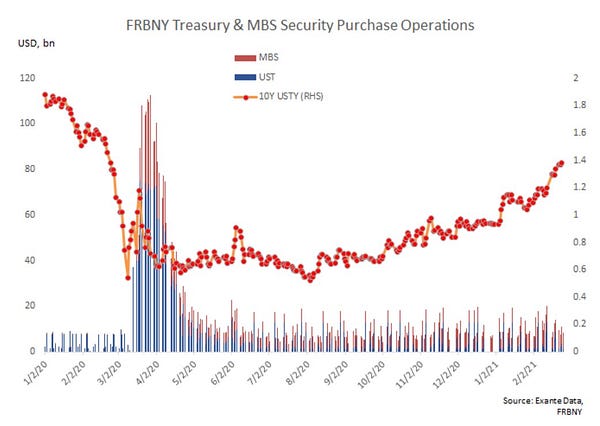

There is really nothing wrong with that. Many market participants have called on the Fed to step in and calm the market, at least with words if not with real money. And indeed, there’s really little the Fed can do besides words these days. The Fed’s only substantive option is to inject more liquidity into the markets, but that is probably not a good idea given how much it’s already done (see chart below from Jens Nordvig).

El-Erian’s other point from the Bloomberg interview above is:

The worst part is that it’s not clear how you fix it. The problem of relying too long on monetary policy is that the exit becomes difficult, but at the same time doing more becomes difficult. So the Fed will stay with the same script, only because there is no other script right now.

There is an issue of inflation risk. The real risk here is that the price level change will likely be much higher than what the Fed has been saying. It doesn’t mean the Fed is wrong because there likely still won’t be any fundamental inflationary dynamic, but the danger is that the market won’t be able to tell the difference between price level change and real inflation coming in. The central bankers can recognize the distinction, but not the market participants, and that could lead to more disruptive dynamics.

And you can see from the tweets below (and the vast amount of market commentaries out there) that the Fed is really in a tough spot. If they want to calm the market, they’d have to say something or do something. But whatever they say/do, they’d risk being seen as too hawish/dovish. The markets are so volatile and narrative-driven these days that any such signals would just add more layers of interventions to the markets, which means that this will only make it harder for the Fed to exit its current set of policy interventions down the road.

Perhaps a good time to buy the stock market dip?

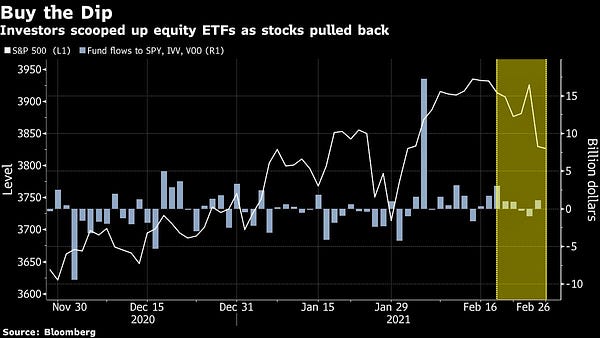

So some of you have complained to me recently: “Tiger you first said it’s a good time to buy Bitcoin, then you wrote another email saying probably not right now – I don’t know what to do anymore bro…” Well, let me add to your confusion by saying that this might be a good time to go into equities markets – at least that’s what a lot of people thought apparently (see chart below):

This saga on yields, bonds, inflation, and market volatility is to be continued…

Disclaimer: Needless to say, my emails are just casual commentaries. I try my best to write them thoughtfully and with care to provide some alternative perspectives on various issues, but please do not treat them in any way as financial advice for your own investment.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!