We're in a very young bull market...

This article was originally published on 11/18/2020 for my informal email list. I’m re-posting some of my earlier newsletters here as a gradual process to shift to Substack.

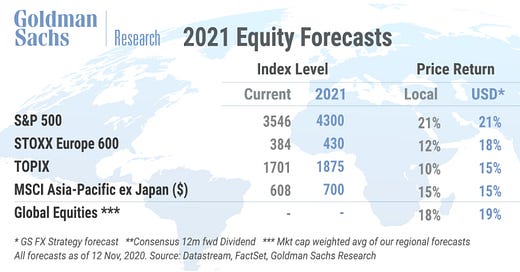

Goldman Sachs released their 2021 equities forecast a short while ago. As you can see from the chart below, they’re putting S&P at 23% return and even STOXX Europe 600 at 21%. Very bullish.

One reason they gave is that they "do not think markets have yet priced a robust cyclical recovery.” As I’ve previously showed, the S&P 500 is up this year primarily because it’s led by the five mega-cap “FAAMG” firms are up roughly 40% (Facebook, Apple, Amazon, Microsoft and Google, which together account for about 1/5 of the index market capitalization). The larger the firm, the more weight in the index, and the more it carries the index up. So, it skews the picture – the rest of the market is still down this year.

Cyclical assets are those that do well and badly following the larger trend of the economy, so they do well when the economy at large does well. These assets are like restaurants, hotels, airlines, retailers, manufacturers, etc. Not the Big Tech companies. These conventional cyclical assets have largely underperformed in the past few months (see chart).

Goldman is therefore saying – if the economy does better, these cyclicals will also do better, and the markets won’t just be carried by FAAMG anymore. Sure, the markets have been HUGE, but they’ll be up even HUGER because of the broad-based recovery.

This all makes sense (markets will do better when the economy fully recovers), but the more important claim by them seems to be that they don’t think the stock market is really overpriced and all this optimism has not already been priced in. That is something I’m slightly skeptical about. Recall that if you were talking to an investor early this year even three months before Covid happened, many of them would be complaining how the stock markets should have a 20-30% healthy correction because the valuation is too high for everything.

This does not seem to be the case anymore, and investors have become much more comfortable with this ever prosperous trend we’re headed towards. I acknowledge there are certainly factors beyond just business fundamentals that are carrying the markets up: like the Fed’s low interest rate for the foreseeable future and apparent inability to exit out of the current money-printing spree, combined with very low inflation expectation (outlook is around 0.5-0.75% which is significantly below 2%). But are these factors that important such that they're enough to overshadow the horrible underlying economy?

So here seems to be the ultimate logic: these pro-markets macro factors weren't present before Covid, so people only focused on the business fundamentals, and clearly back then sensible investors recognized that the markets were overvalued. But now, business fundamentals have become even worse, but fortunately we got all these additional macro factors like Fed pumping money to justify a bull market, so we should actually just care much less about the business fundamentals right now. In fact, forget that we ever worried about the markets being overvalued. That's a stupid thought.

It's just amusing – 4 months ago people are still freaking out about how the markets seemed disconnected from the Covid depression & Main Street suffering reality, and today the narrative is that we're in the beginning of a very young bull market (even though the markets have been going up pretty much nonstop since March in a global recession and is arguably even more overvalued than ever)...