Shut up about Bitcoin, seriously…

We’re now in the age of excess when it comes to the media & investors talking about Bitcoin all day long cuz' they can't generate alpha elsewhere. With emotions running high, is another crash coming?

A couple quick points in this email:

The media is talking a lot about Bitcoin these days. But Bitcoin is just really not that deep or hard to understand, and if you spend more than a few hours on the topic, the arguments start to become very repetitive and noisy.

So why are the media and investors all talking so much about Bitcoin?! FOMO? Or are they simply unable to generate alpha elsewhere? Or perhaps because the whole finance-media apparatus is trying to get more people in on the Bitcoin game so that they can profit?

I care about what media has to say about Bitcoin for two reasons:

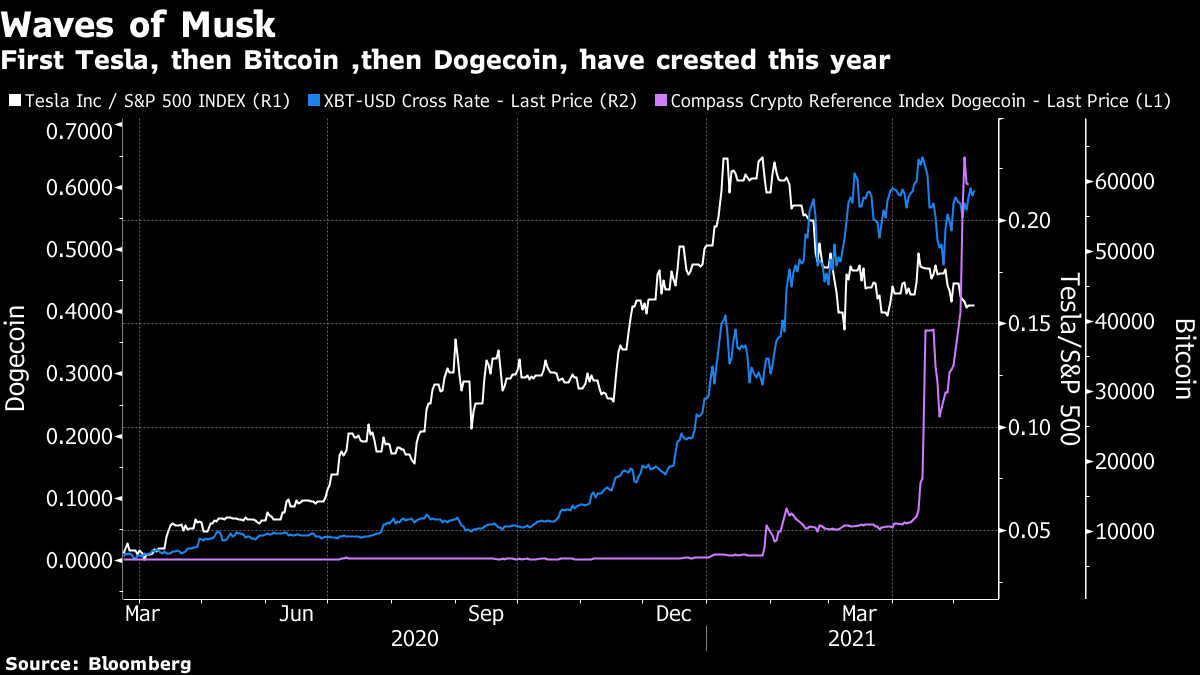

Tesla peaked at about the same time as the GameStop saga; then Bitcoin and Dogecoin peaked when Elon Musk went on SNL (Bitcoin price has fallen more than 50% since those days). The prices literally “topped” when the media chatter and emotions topped.

More media chatter —> more noise & nudge to invest —> more undesirable market dynamics —> more people get hurt. Not good.

Just so many articles about Bitcoin…

Every news outlet is talking about Bitcoin – every day I am getting a notification from Bloomberg, Financial Times, YouTube, or Spotify that a new article or podcast on Bitcoin has dropped. Every financial analyst and investor on CNBC are making some statement about crypto.

When I wrote my first email about Bitcoin in February, I distinctly remember not being able to find more than a dozen articles on the entire Bloomberg.com about the topic. Time has changed – on June 7 alone there were at least 15 articles published about it… The number of articles related to Bitcoin grew more than the asset’s price itself…

Not to be facetious – I understand the broader markets are doing so well these days that it’s becoming increasingly harder to beat the market, but has it become so hard to generate alpha that you have nothing to invest in or talk about besides Bitcoin?

It is completely unnecessary for any news outlet to publish like 17 articles on Bitcoin on a single day. Just not adding anything at all.

Bitcoin is really just not that sophisticated

I’ve largely resisted writing about Bitcoin again largely because there’s really not that much more to talk about it… I’ve written like 4 emails about Bitcoin and I feel that’s honestly pretty adequate:

one email on the fundamental properties of Bitcoin and the pro vs. con debate of its investment thesis;

one email on why its political vision is largely unviable;

one email on the speculative bubble debate of Bitcoin;

one email on why all the price predictors for Bitcoin are BS and why you shouldn’t listen to the media about Bitcoin.

Surely there are other more nuanced matters related to Bitcoin that we can talk about (and we did interview Princeton computer science professor Matt Weinberg about the technical details of designing cryptocurrencies). But overall, 4-5 articles should be sufficient in articulating one’s overall framework in thinking about this new asset class. Likewise, if you listen to 2-3 long-form podcasts about Bitcoin, you should have familiarized yourself with most of the central arguments by that point. You don’t really need more beyond those.

And once you got the first principles down for thinking about Bitcoin, there shouldn’t need much more day-to-day reading or writing about the exact price movements. You’ll have successfully developed a core understanding of the topic.

This is why I think we’re in the age of excess now when it comes to Bitcoin media. Many months ago, journalists and investors were still asking genuine questions about the crypto space (which I think they still are, and we’re still in a very early stage when it comes to the growth of the overall industry). Now, however, every financial show every day is talking about Bitcoin, and every Joe Schmoe is tweeting out Bitcoin price prediction charts…

Bitcoin topped when the narratives topped?

I care about what the media (which includes Elon Musk) has to say about Bitcoin because these narratives influence the prices and even fundamentals of Bitcoin, which is ultimately a “money” that is backed by people’s beliefs & faith in it at the end of the day, without which it cannot survive. John Authers of Bloomberg emailed out this wonderful chart on 5/10:

Tesla peaked at about the same time as the GameStop saga; then Bitcoin and Dogecoin peaked when Elon went on SNL before crashing down shortly afterwards. Authers wrote: “Once one narrative loses its power to keep piling on excitement, it seems that people feel the need to move on to the next.”

Authers also wrote a follow-up analysis on 5/20:

If there are tentative ways to measure the technicals, there are also tentative ways to measure the emotion that undeniably drives much trading in bitcoin. Peter Atwater, who analyses social moods that influence investment patterns for Financial Insyghts, suggests that the falling out between Musk and Dave Portnoy of Barstool Sports Inc., another of the biggest bitcoin backers, was a tell that the top was near. “On the way up, there’s enough money for everyone that the revolutionaries don’t go after each other. To me, the Portnoy-Musk dispute introduced a sense of finiteness — now, in order for one to win, the other had to lose.”

Then, of course, there was Musk’s appearance on Saturday Night Live; an event that gobbled publicity for weeks, and showed that the bitcoin phenomenon had passed beyond markets. If ever there was a moment to mark an emotional peak, this was it. That came with a proliferation of videos on YouTube telling people how to create their own crypto-coins. Whatever the merits of bitcoin itself, the signs that it had taken on some disreputable hangers-on were clear. When money is seen as that easy to make, it is never a good sign.

These words summed up the influence of narratives on market dynamics really well.

More people will hop on the Bitcoin train because the media has implicitly told them to

Sure, not everyone in the media are saying the same thing about Bitcoin – some are more bullish and others more bearish – but there nevertheless seems to exist a concerted push by the financial ecosystem to get everyone in on this crypto train.

It doesn’t matter what exactly the media are saying; it matters that they are saying it. If the TVs in every sports bar and barber shop are playing CNBC, more Americans will buy stocks, no matter what the commentators actually express. If everyone – from top economic policymakers like Larry Summers to legendary investors like Ray Dalio – are all talking about Bitcoin, then more people will buy it…

Everyone’s talking about Bitcoin partly because it is indeed one of the most significant developments in the financial ecosystem for a long time, but also partly just because they don’t want to be left out. Regardless, the unfortunate byproduct is that everyone ends up saying roughly the same thing, and it becomes a downward spiral where the sheer volume of media chatter will create undesirable market dynamics, such as seduing more inexperienced retail investors into the space, or giving a lot of air-time to self-pronounced crypto experts who are in fact just trying to sell you their product.

This is just pushing for ever greater financialization, in the form of Bitcoin, and I’m pretty sure it’s not going to end well. With the continued enthusiasm and emotions, are we going to have another crash soon? If more people shut up, will we have another crypto bull run?

The saga of Bitcoin is to be continued…

Disclaimer: Needless to say, my emails are just casual commentaries. I try my best to write them thoughtfully and with care to provide some alternative perspectives on various issues, but please do not treat them in any way as financial advice for your own investment.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!

If you can’t find my emails in your inbox, please check your spam folder and in the “Promotions” tab for your Gmail. You may mark this email address “tigergao@substack.com” as “not spam” or “trusted sender” in your settings. Please feel free to let me know if you still have trouble receiving my emails.