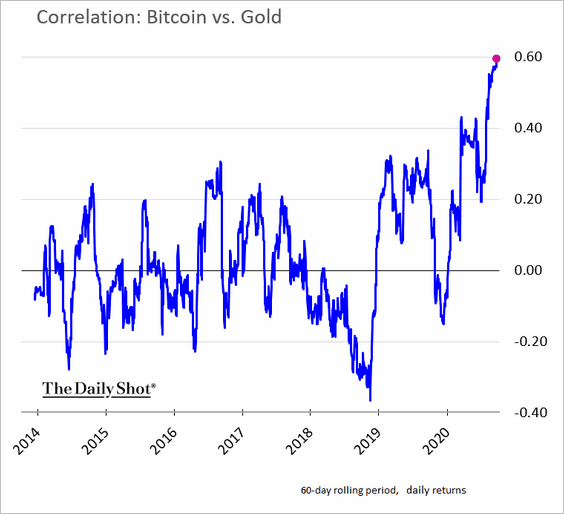

If Bitcoin is the new gold, we're in deep trouble...

It is naive market liberalism to try to create a unified commodity money that would result in forever peaceful economic growth & fluid transactions. The gold standard failed; Bitcoin won't succeed...

Many of you told me that my email yesterday convinced you that the Bitcoin price will keep going up and changed your old perceptions. Thank you for your kind words of encouragement for my emails – you make all the late-night writings worthwhile and fulfilling :)

People are right for the wrong reasons

I think it’s important to distinguish between the political and the investment outlooks of Bitcoin. The two extremes on today’s Bitcoin opinion spectrum are:

The all-in Bitcoin enthusiasts (like those on Twitter and Clubhouse) believe that Bitcoin will replace dollar and be the solution to today’s problems from the Federal Reserve’s excessive money printing to inequality. So, its price will keep going up.

The skeptics (like academic economists and political theorists) believe that Bitcoin’s political vision will never work out, so its price is a big bubble.

I think the truth is in the middle: Bitcoin’s political vision likely won’t work out, but its price will likely continue to go up.

One extreme uses Bitcoin’s rising price as an indicator for it having all-encompassing abilities to solve all the problems in the world; the other extreme uses the fact that Bitcoin will never replace dollar to conclude that its price will eventually fall to zero.

Both extremes are wrong. They take one small part of a complex system where they got things right as evidence for the overall correctness of their predictions. This is very flawed thinking.

Please don’t allow Bitcoin to replace fiat money if it’s the new gold

Onwards to today’s main theme – is Bitcoin the new gold? The enthusiasts would say yes. Not only is Bitcoin is the new gold, it is even more secure (because of blockchain), easy to store (no need a vault), technologically friendly, and attractive to the younger generation…

Ok, say Bitcoin is indeed the new gold, then I think the crucial lesson should be: Bitcoin will go up in value; it will be a store of value and possibly medium of exchange; but let’s please stop there and not let it become politically dominant in any way.

The gold standard ended disastrously, so if Bitcoin is the new gold, we should try our best to not let Bitcoin replace dollar or any fiat currency for that matter!

The dramatic failure of the gold standard idealism

To explain why the gold standard was so bad, I want to share a bit of political theory and the writing of the great economic historian and social philosopher Karl Polanyi. His book The Great Transformation: The Political and Economic Origins of Our Time is an eternal classic in the history of political thought and economic development.

Gold standard and Bitcoin are “commodity money” – money that is specifically linked to a certain commodity that is often limited in quantity so that one can believe that it has some “intrinsic” value.

Before the whole Bretton Woods system was set up after World War II, the gold standard had already been widely adopted by the 1870s and was intended to create an integrated global marketplace that could reduce the role of national units and national governments.

The consequences were the exact opposite. Market liberals dreamed of a pacified world in which the only international struggles would be those of individuals and firms to outperform their competitors, but Karl Polanyi showed that such efforts through the gold standard ended up intensifying nationalistic identities and producing the two World Wars.

As Fred Block explained in his Introduction chapter for the newest edition of Polanyi’s The Great Transformation:

When a nation’s internal price structure diverged from international price levels, the only legitimate means for that country to adjust to the drain of gold reserves was by deflation. This meant allowing its economy to contract until declining wages reduced consumption enough to restore external balance. This implied dramatic declines in wages and farm income, increases in unemployment, and a sharp rise in business and bank failures.

…

Polanyi argues that the utopianism of the market liberals led them to invent the gold standard as a mechanism that would bring a borderless world of growing prosperity. Instead, the relentless shocks of the gold standard forced nations to consolidate themselves around heightened national and then imperial boundaries. The gold standard continue to exert disciplinary pressure on nations, but its functioning was effectively undermined by the rise of various form of protectionism, from tariff barriers to empires. And yet even when this entire contradictory system came crashing down with the First World War, the gold standard was so taken for granted that statesmen mobilized to restore the it. The whole drama was tragically played out again in the 1920s and 1930s, as nations were forced to choose between protecting the exchange rates and protecting their citizens. It was out of this stalemate that fascism emerged.

…

In short, the neoliberal utopia of a borderless and peaceful globe requires that millions of ordinary people throughout the world have the flexibility to tolerate – perhaps as often as every five or ten years – a prolonged spell in which they must survive half or less of what they previously earned. Polanyi believes that to expect that kind of flexibility is both morally wrong and deeply unrealistic.

In the long run, prices and output would adjust back to their appropriate levels, but in the process of these adjustments that often take many years, livelihoods were destroyed, and the economic pain imposed on the average citizen is simply too much. It is not so much that market liberalism isn’t a desirable outcome, but that its demands on ordinary people are not sustainable. The country and markets may survive, but the people will not.

Political theorists and economists have spent the last few decades since Polanyi’s writing to study these issues, and this is only one of the many arguments against something like the gold standard. You get the idea by now – this is why academics dislike this whole idea of Bitcoin because they see it as a new vision that will still largely preserve the same political and economic dynamics.

The fundamental lesson from Polanyi exposes the naivete of market liberalism: one couldn’t just simply create a unified commodity money that would result in forever peaceful economic growth and fluid transactions between all people and countries.

You can’t have it both ways

Bitcoin enthusiasts believe that Bitcoin is the new gold, but they refuse to recognize the limitations of the gold standard. It’s entirely fine to have Bitcoin be the next gold and stop there, but we probably shouldn’t go further and argue that it will help us return to the “good old days” of commodity money except this time with additional features like “decentralized technology” and “blockchain”…

If Bitcoin were to ever replace dollar or have any political value, it shouldn’t just be the new gold. That will not get us to a better place. But if you make Bitcoin a viable political vision, perhaps it won’t be the new gold anymore and its price won’t keep skyrocketing (or it might still go up, I don’t know…). But between the money and the political progress, I don’t think you can have it both ways…

To be continued…

Disclaimer: Needless to say, my emails are just casual commentaries. I try my best to write them thoughtfully and with care to provide some alternative perspectives on various issues, but please do not treat them in any way as financial advice for your own investment.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!