Seriously, why not invest all your money in stocks?

Not trying to be rhetorical or facetious. I genuinely don’t have an answer to this question. If markets will go up no matter what, and bonds lost their hedging efficacy, why not go all in on stocks?

The S&P 500 was down -34% last March but actually finished +18% up year-over-year at the end of 2020. The same tale happened in 2019, when the index was down -7% at one point but eventually finished +26% for the full year compared to 2018. And likewise for many of the previous crashses outlined in the chart below. History has shown us that not only has the stock market always bounced back, it continues to go up again and again in the medium and long term.

“STONKS ALWAYS GO UP”

Is the stock market in a big bubble? And is now (at historically peak level) still a good time to buy in more stocks? Most would say YES with reasons that I’ve written about in detail:

Covid recovery will carry the markets upwards; even if the recovery is slow, at least we’re not taking the same type of risks as before that would actively hurt the economy in any way;

Fundamentals of the financial system weren’t damaged like back in 2008. There are also just too many positive things today preventing the 2008 Great Financial Crisis from happening again in 2021;

The Fed will hold up the market through continued quantitative easing (QE) that will continue to inflate financial assets;

blah blah blah…

Because the market outlook for 2021 is just so extremely very good, it seems to me that the stock market is essentially making such a proposal to the American people:

Give me a portion of your asset and I’ll manage it for you. You may withdraw the money from me anytime you want.

The value of your portfolio may go down by a lot at some point (say suddenly down 50% in a week because of some unknown volatility), but as long as you stay patient and keep your money with me, I can guarantee you that I’ll eventually generate outsized positive returns for you (say 120% back to you in 3 years or 150% in 5 year, with unlimited upside and much better than your local banks’ interest rate).

The bottom line is: the markets will have some really bad days, but stocks have been and will continue to go up in the long run. You may lose a lot of money at one point, but if you can be patient, eventually in the long run you’ll make it all back with more.

So what’s holding you back from investing all your money in stocks?

Given the logic above, here’s the very basic Finance 101 question that has been puzzling me: what’s preventing you from putting all your money in the stock market?

Let me clarify the question. By you, I literally mean you, the individual, small-time, non-professional investor who have a few thousand or a couple million of dollars on your hand as savings. You don’t have billions of dollars of assets under management (AUM) like BlackRock or Fidelity to engage in sophisticated arbitrage or some obscure foreign currency play; nor do you have unique access to invest in high-growth private companies like the private equity/venture capital funds; nor do you want to put all your money into buying a single house to invest in real estate; nor are you familiar or comfortable about assets like Bitcoin or commodities (gold, oil, etc.)…

So you probably only have two main choices left: public equities (stocks) or fixed income (bonds). And this is indeed what most Americans put their money in, and hence there is the very famous “60/40 portfolio” where one is typically instructed to put 60% of assets in stocks and 40% in bonds to best diversify risks while generating positive returns.

But there aren’t really any good reasons to buy bonds now

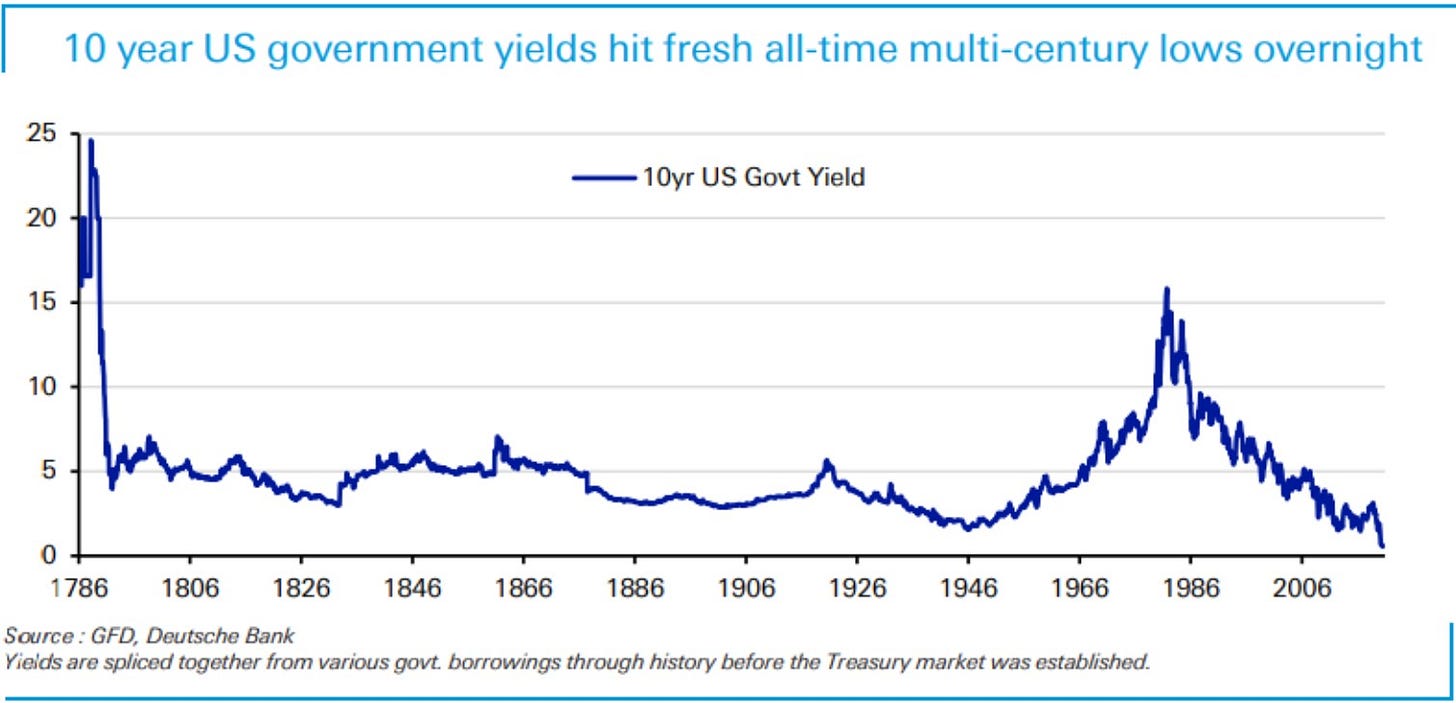

The only issue with the 60/40 portfolio is that it doesn’t really work anymore. Bond returns are at multi-century lows given the historically low interest rates, while stocks seem to be going up no matter what given the logic explained above.

Some op-ed pieces have written about how there are still good reasons to buy bonds, except they’re not really good reasons at all. Perhaps the single most major argument for why people buy bonds is to hedge against stock market volatility. However, interest rates can’t really fall any much lower anymore even if the stock market goes down, meaning that even if stocks go down there is no guarantee that bond yields will go up, so the efficacy of bonds as a hedging device is really low.

The stock market is now also heavily driven by a small subset of large corporations rather than a broadly diversified set of companies. I previously sent out a chart from Apollo Chief Economist Torsten Slok that between mid-Febuary to late-October, the positive returns in the S&P 500 were driven by the 37% increase in FAANG stocks (Facebook, Amazon, Apple, Microsoft, Google), while the other 495 companies in the S&P 500 were down 2 percent over the same period. Therefore, you can buy all the bonds you want, but your portfolio is still going to be driven by a few stocks.

If your portfolio is never really diversified to begin with, and if the stock market will eventually go up no matter what, what’s holding you back from investing all your money in the stock market? Why not move the 40% remaining assets in bonds and cash all into the stock market?!

The question above is not rhetorical, and I’m not trying to be facetious. I genuinely don’t have an answer.

Can someone tell me what’s going on?

The idea that stocks will go up no matter what sounds almost too good to be true, but it is literally what everyone is saying today in the market. The ensuing logical conclusion should be that all retail investors should just pour all their money into the stock market, and that’s indeed what happened in the past few months – the rise of Robinhood traders literally made Elon Musk the richest man on Earth!

In today’s market environment, the most logical and rational thing for a retail investor to do seems to be simply pouring all their money into stocks, which are almost guaranteed to go up if investors are patient enough to ride out any volatile waves and hold on to their stock positions for a decently long period of time.

If so, why should anyone call the Robinhood traders “stupid” speculators who seem to be doomed to lose money? Are they actually doing the right thing?

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!