Not surprised that Fed is surprised about inflation...

Inflation has been off-the-charts for so long – nobody knows what's going on anymore. Just take whatever data you need to justify your politics, and whatever politics to justify your data...

Yesterday Chair Powell delivered the press conference for the Fed’s June FOMC meeting. Everyone had been waiting for this meeting to see whether inflation is indeed as off-the-chart as predicted. So what did the Fed conclude? I am genuinely not sure… At least the Financial Times’ conflicting headlines from last night only made me more confused about what’s actually happening:

Inflation not transitory, or is it?

From FT:

Treasury yields surged and US stocks slipped after policymakers at the Federal Reserve signalled that they expected to lift interest rates in 2023, a year earlier than previously thought.

What scared people is the fact some FOMC members said the Fed should start talking about tapering and rolling back liquidity support soon:

a number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.

Well this should be big news? Many investors feel validated that the Fed would tighten earlier than some FOMC members had previously thought, and perhaps Powell is showing signs of admitting he could be wrong on this whole “transitory” inflation thing? (The word “transitory” had barely appeared in Powell’s remarks on Wednesday).

But Powell didn’t say they were wrong, worried, or surprised; nor did he actually announce any substantial short-term timeline that we would be able to follow. The overall message is still that THEY GOT EVERYTHING IN CONTROL. If the Fed needs to step in, they have the tools. This script is getting old.

I’m not saying investors are nitpicking the Fed’s message, since it’s indeed important to read into the Fed’s signal when they say they might tighten earlier than expected. But it’s hard to conclude from Powell’s words that inflation is actually NOT transitory, or that it is? I think we can just take it however we wish at this point…

The question on my mind is – what would be the inflation rate that will get the Fed to start tightening prematurely? 6%? 8%? At what point will they say “ok this is not really transitory anymore”? Because nowadays even if we see like 4%, 5% inflation, Fed can always say “well it’s cuz’ the price level is compared to last year; and the PCE index is flawed, so if you look at this & this, it’s actually not so bad” blah blah… So how bad does it need to get?

The Fed’s message was hardly a surprise, was it?

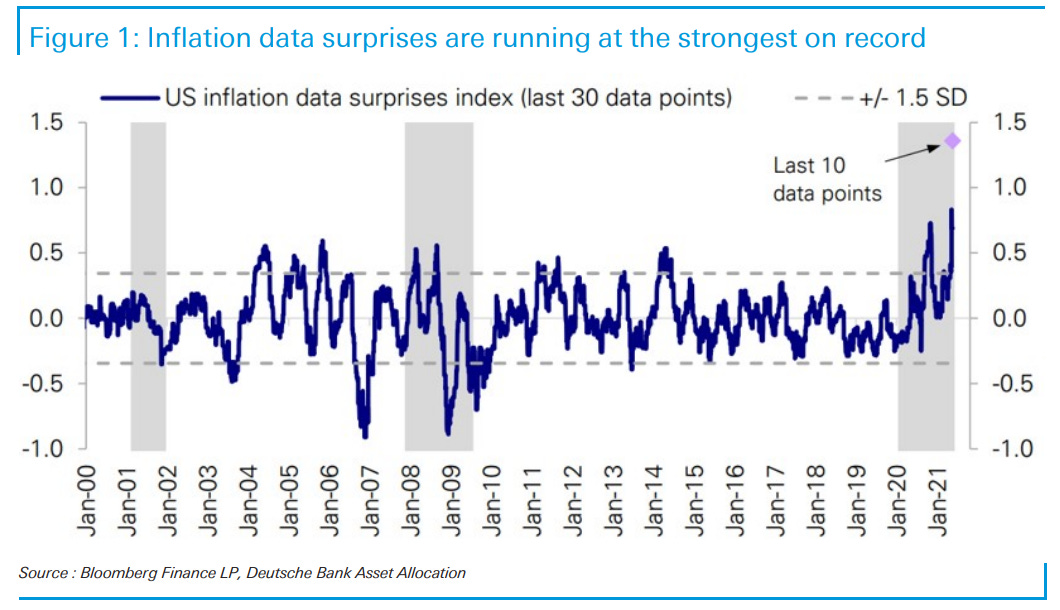

Another reason why I don’t see anything paradigm-shifting from this FOMC meeting is that investors might start to be no longer surprised that the Fed could be surprised. See chart below:

US inflation data surprises are at their highest in the 20-year history of the series with the last 10 data points almost “off the chart”. Note that inflation surprises during the [2008 Great Financial Crisis] were sharply negative and didn't positively overshoot after. During the pandemic we didn't undershoot and are now overshooting massively.

While it is easy to blame transitory factors, these were surely all known about before the last several data prints and could have been factored into forecasts. That they weren’t suggests that the transitory forces are more powerful than economists imagined or that there is more widespread inflation than they previously believed.

Even though everyone was talking about inflation, people had still been surprised by the inflation data. This should be causes for worry to a certain extent. And if everyone gets surprised for too many times, such that they no longer feel surprised when inflation is off-the-charts the next time around, then that is when inflation expectations could start getting unanchored and persistent inflation become a real issue.

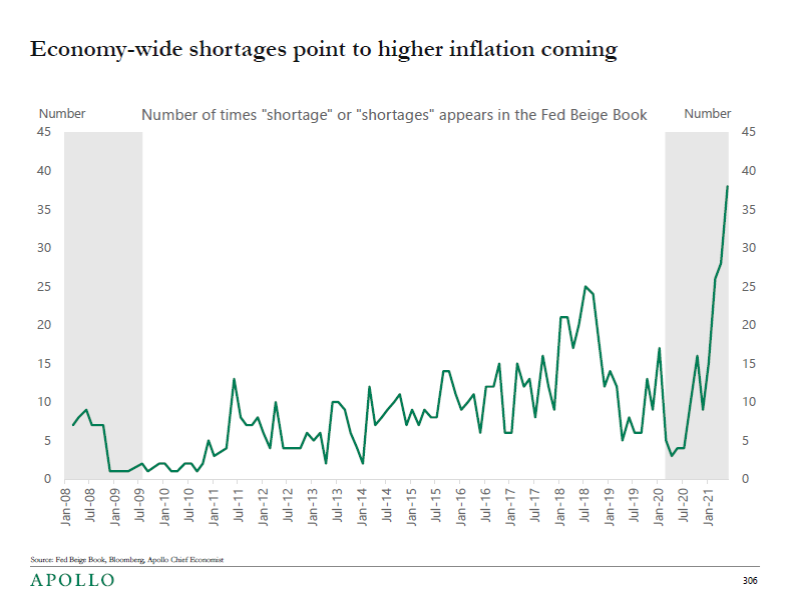

Apollo Chief Economist Torsten Slok has been sending many charts that show labor market is becoming quite tight and wages are climbing higher. Looking at these charts every day, one shouldn’t be surprised that inflation would jump much higher than expected, right?

The US economy is currently characterized by significant shortages across industries, which tells us that more inflationary pressure is building.

The Fed has built an index to measure the probability that core PCE inflation over the next 12 months will exceed 2.5 percent. In technical terms, the price pressures measure is constructed from an ordered probit model using 104 different data series grouped in the following categories: (1) consumer price indexes, (2) producer price indexes, (3) commodity prices, (4) housing and commercial property prices, (5) labor market indicators, (6) financial variables, (7) inflation expectations, (8) business and consumer survey data, and (9) foreign price variables. This Fed model currently predicts that there is an 85% chance that inflation will exceed 2.5 percent, on average, over the next 12 months.

Does the inflation analysis all come down to narrative & sentiment?

Deutsche Bank released a long report on 6/7 titled “Inflation: The defining macro story of this decade.” DB’s official “House View” is that inflation is transitory, and this report was published to offer an alternative perspective on why persistent inflation could happen and why we should worry about it. Some highlights of the report are:

US macro policy and, indeed, the very role of government in the economy, is undergoing its biggest shift in direction in 40 years. In turn we are concerned that it will bring about uncomfortable levels of inflation.

In short, we are witnessing the most important shift in global macro policy since the Reagan/Volcker axis 40 years ago. Fiscal injections are now “off the charts” at the same time as the Fed’s modus operandi has shifted to tolerate higher inflation. Never before have we seen such coordinated expansionary fiscal and monetary policy. This will continue as output moves above potential. This is why this time is different for inflation.

History is not on the side of the Fed. In recent memory, the central bank has not succeeded in achieving a soft landing when implementing a monetary tightening when inflation has been above 4%.

Human biases are also feeding the “transitory” narrative. Just one example regards inflation expectations. These have proven near impossible for economists to model. Hence, the profession will overweight the bottom-up micro components – they are easier to predict. Furthermore, model-based analyses find it difficult to predict the turn in inflation if prompted by a paradigm shift that raises expectations.

Setting aside all the details regarding whether we’re indeed seeing any actual signs of inflation, I think the core argument the report comes down to “we’re undergoing the biggest paradigm shift in economic policy in 40 years.”

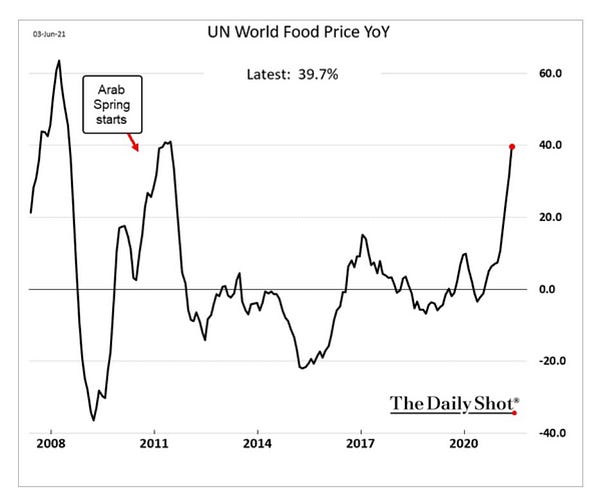

In other words, “this time is different” – not just because of higher used car prices or oil prices or whatever ticker you find, but because there is a fundamental shift in the way people perceive how far the government is willing to go to bring out inflation and stimulate the economy. This is when inflation expectations become unanchored, and this is the real real danger of inflation running wild.

But then, I suppose, you can turn the report on its head:it seems that you don’t know inflation is coming for sure, and you’re relying on some very “narrative” & “sentiment” related factors to argue that inflation is coming, and that sounds a bit iffy.

So, you can choose to not trust the Fed forecasts anymore (especially given all their patience reacting to data rather than preemptive strikes), but you can also say “well it seems that all those people that are saying that inflation is coming are also relying on some very strong assumptions and even iffy sentiments” – so I guess we don’t really know at the end of the day, do we?

It’s all a big loop! Maybe just take whatever you need…

While the inflation debate relies so heavily on the political vision and narrative, the politicians are counting on the inflation debate to justify their political vision. Our team’s James Cross, who’s currently working for House Minority Leader Rep. Kevin McCarthy (R-CA 23), texted me this:

Republicans are pointing to prominent Democratic economists like Jason Furman and Larry summers – who were skeptical of the Resuce Plan and in some cases warned of inflation – and that’s weighing on the infrastructure debate.

Republicans are trying to remind voters about inflation as a political issue (it used to be a top concern but hasn’t been since the 1970s) and mobilize it as a political weapon.

On the Democrats’ side, they’ve largely avoided the issue, although White House Chief of Staff Ron Klain has made some points about how price comparisons from a year earlier don’t make much sense because certain industries (used cars, air travel) were entirely shut down during the pandemic.

Republicans say “look inflation is coming if you look at the data,” then Democrats say “well the data aren’t really that indicative because they’re in comparison with the worst time in middle of Covid.” The inflation debate sounds like can go either way; you just find whatever data you need to support the political stance, and there is no right/objective way to measure inflation when it’s so politicized.

So economists are looking at the politicians and thinking: “oh they’re putting out these reforms and visions, which would justify this inflation number.” And the politicians look at the economists and think: “oh they’re putting out these numbers, so we should be able to push for this platform…”

Just take what you need to justify what you believe in. It’s all just a big loop at the end of the day. Who actually knows what’s going on with inflation? I don’t. If you do, please enlighten me, and I might finally start having a better time not over-worrying about inflation all the time:

The saga of inflation is to be continued…

Disclaimer: Needless to say, my emails are just casual commentaries. I try my best to write them thoughtfully and with care to provide some alternative perspectives on various issues, but please do not treat them in any way as financial advice for your own investment.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!

If you can’t find my emails in your inbox, please check your spam folder and in the “Promotions” tab for your Gmail. You may mark this email address “tigergao@substack.com” as “not spam” or “trusted sender” in your settings. Please feel free to let me know if you still have trouble receiving my emails.