Why follow Fed forecasts when they don't even listen to themselves?

We now have a reactive, not preemptive Fed. They won't act based on forecasts, so if I believe inflation is coming, I should have every reason to trust my own forecast and not the Fed's script...

Today’s email is a short note about the Fed’s significant regime change from being “preemptive” to “reactive.”

The punchline is: Fed policymakers used to design policies based on flawed forecasts, and Jerome Powell has been trying to change that by being more reactive. They’re not going to set policy preemptively based on forecasted outcomes; they will make a decision on what to do after data comes in and shows how inflation & employment perform.

I see 4 distinct implications / risks to this new regime:

The new regime increases inflationary risk;

The lag to reactive policy will only lead to more dramatic tightening later;

If the Fed is not going to act based on forecasts, why not just simply choose to ignore the Fed? If I am an investor and believe that inflation is in fact going to rise much more quickly than what the Fed believes, then I should have every reason to trust my own forecasts and not the Fed’s.

The markets could freak out when they see higher inflation and decide to no longer trust the Fed, which will lead to disruptive market dynamics. Or, they could simply fall asleep following the Fed’s script even if it’s wrong, since they’re not incentivized to correct Fed’s incorrectly accommodative policy that is making them richer.

The preemptive Fed was wrong, and Powell’s reactive Fed wants to be right

I’ve written many, many emails about the Phillips Curve and how our understanding of inflation has dramatically evolved. Here’s a brief history of how we realized that the old policy regime was flawed:

The Fed under Janet Yellen used to be very proactive and had “preemptive strikes” – meaning that they would tighten policy and raise interest rates when they thought that unemeployment rate was already at a low enough level. They did this because the common wisdom had been – if you only start tightening when you actually saw inflation, that would already be too late.

But it turns out that nobody really knows how low unemployment can actually go. Is it 3%? 3.5%? Or 4%? The great economic boom during the pre-Covid Trump/Powell era showed that you can in fact let the economy run hot and have historically low unemployment rate without seeing inflation at all.

Powell's first Jackson Hole speech back in 2018 was about “navigating by the stars.” The stars refer to r* (the neutral interest rate), u* (the natural rate of unemployment), and π* (the inflation objective). Academics, Fed economists, and market participants now all agree that our previous “wisdom” on these stars was flawed. Powell said:

For example, the famous Taylor rule calls for setting the federal funds rate based on where inflation and unemployment stand in relation to the stars. If inflation is higher than π*, raise the real federal funds rate relative to r*. The higher real interest rate will, through various channels, tend to moderate spending by businesses and households, which will reduce upward pressure on prices and wages as the economy cools off. In contrast, if the unemployment rate is above u*, lower the real federal funds rate relative to r*, which will stimulate spending and raise employment.

Navigating by the stars can sound straightforward. Guiding policy by the stars in practice, however, has been quite challenging of late because our best assessments of the location of the stars have been changing significantly.

Powell goes on listing how the Fed had been wrong in estimating these various stars and led to sub-optimal policies. His “criticism” of the old regime can be seen as quite strong in hindsight. He was essentially saying that policymakers had been guided by these metrics (stars) without knowing where they actually are in reality.

So, in 2019 and 2020, the Fed did many “Fed Listens” events across the countries that were meant to better understand what the public thought about the Fed policy. They realized that letting unemployment rate fall low is actually extremely important for lower-income communities and racial minorities, and by doing these preemptive strikes they could be hurting these people.

All this probably made Powell realize: our current actually low inflation environment is a bigger problem than a possibly high inflation future that we may not even get to. Low inflation hurts people, and we should at least try to solve that.

Covid-19 accelerated the regime change

I prefaced all that long history above to show that a lot of people were unsatisfied with the Fed’s preemptive policy. Jerome Powell really wants to get it right.

When Covid-19 hit the economy, the Fed went into rescue with unprecedented speed and will. All these thinking also gradually converged, and the Fed became determined that they would no longer repeat the old mistakes of tightening too early.

Since last summer, the message from every senior official of the Federal Reserve has been consistently the same: the Fed will continue to support the economy with accommodative policies until employment targets are met and they see sustained inflation at 2%.

This is the new normal: no tightening until at least 2022; not raising interest rate until at least 2023; high government debt that is now considered politically and fiscally acceptable, etc.

4 risks & implications to this new reactive regime

Every economist I’ve listened and talked to have said this regime change is frankly quite huge – the Fed isn't even going to start to tighten monetary policy until they're actually past full employment and see 2% inflation for a while. That's pretty different than the old regime where they started to tighten well before we got full employment.

Here are four implications that I think are important:

1) The new regime increases inflationary risk

The current Fed wants the economy to run hot for a bit before deciding. Powell thinks whatever inflation we see right now will be transitory and not lasting beyond this current Covid recovery, but who knows? What if inflation expectations do end up being unanchored? This false confidence and hubris about transitory inflation is what Larry Summers has been criticizing the economic policymaking community for.

2) The lag to reactive policy will only lead to more dramatic tightening later

Now the entire decision process becomes slower: first the Fed has to get the employment and inflation data, and they sit on them for a bit to wait for more data to come in, and all these data will all have to point in the same direction to eventually convince them that it’s time to tighten.

By then, the Fed could already be quite late in terms of starting to tighten. The fact that the Fed was too slow in the 60s and 70s to begin tightening was part of the reason why we ended up with high inflation.

3) Less need of listening to Fed forecasts

The reactive regime will have implications for how we think about the Fed’s remarks and decisions. The Fed has traditionally been using Summary of Economic Projections (SEP) – the preeminent summary of Fed forecasts – to tell everyone where they see monetary policy headed. They use forward guidance to communicate their thoughts so that the markets can be forward-looking and automatically adjust to meet the Fed’s expectations.

But now if the Fed is simply going to wait for the actual data to come in, what is the point of still closely following the SEP and listening to the Fed?

In other words, if the Fed is not going to act based on forecasts, why not just simply choose to ignore the Fed?!

Sure, of course we will still read the SEP and follow their remarks, but what’s really the point of trying to get ahead of the Fed’s thinking when the Fed’s not really thinking ahead in the first place?

If I am an investor and believe that inflation is in fact going to rise much more quickly than what the Fed believes, then I should have every reason to trust my own forecasts and not the Fed’s.

The credibility to the Fed’s communications is critical to maintaining markets function, and I’m not saying that the Fed is becoming less credible under this new regime. I’m just saying it seems that a rational market participant should attribute less weight to the Fed’s “forecasts” when they themselves don’t even want to act on them.

4) Markets will either freak out or fall asleep; neither is good

I think the Fed will just be saying the same stuff again and again in the coming months: that the economy is still recovering, whatever inflation we see is transitory and fine, and don’t worry they’re still here for us, blah blah… Even if we do see some overheating of the underlying economy, the Fed will likely downplay the damage and significance because they purposely want to overshoot inflation a bit to make up for previous losses.

But this is very hard to pull off! I understand the Fed’s dilemma – it’s really hard to specify how much they want to overshoot inflation and for how long. And they're also not really targeting the actual inflation rate per se; they're targeting inflation expectations, which makes the process even harder to manage. So it’s understandable that the Fed has to stay vague and moderate in their script and stick to it.

The consequence is that market participants will eventually either freak out or they will fall asleep on the wheel.

By freaking out, I mean the markets might say “oh the Fed is so wrong in all this; inflation is definitely coming; I’m not listening to Fed anymore…” and that’s when we will see very disruptive market dynamics.

By falling asleep, I mean the markets could also just really trust the Fed, regardless if the Fed is right or wrong. Because the Fed repeats the script so beautifully every time, and this current script helps prop up the markets and make everyone rich, then there’s not really motivation for the markets to not believe that we’re all doing just fine.

The market participants are not incentivized to correct Fed’s accommodative policy; they want the Fed to keep the party going! It’s like the DJ says he’s purposely letting the party go on for a bit longer to make up for starting the party late, but you know the party started on time – are you gonna tell him that in fact the party should’ve ended by now? No!

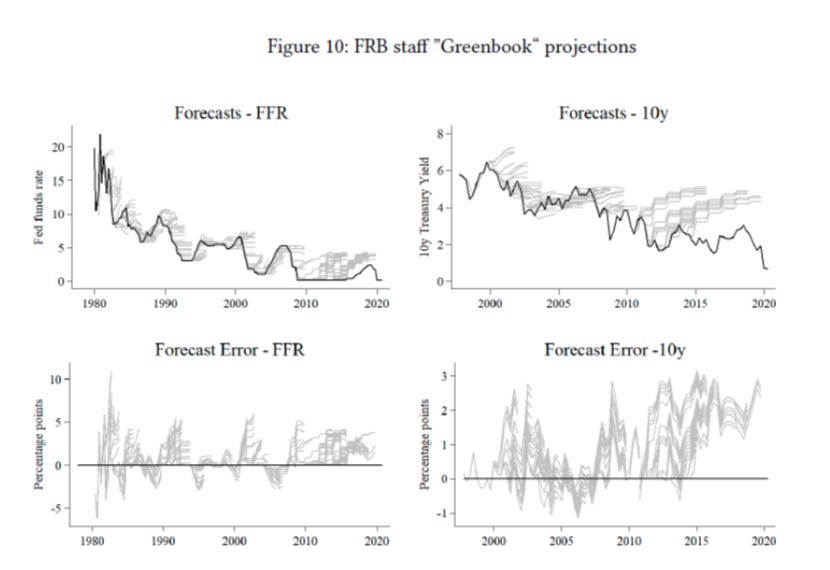

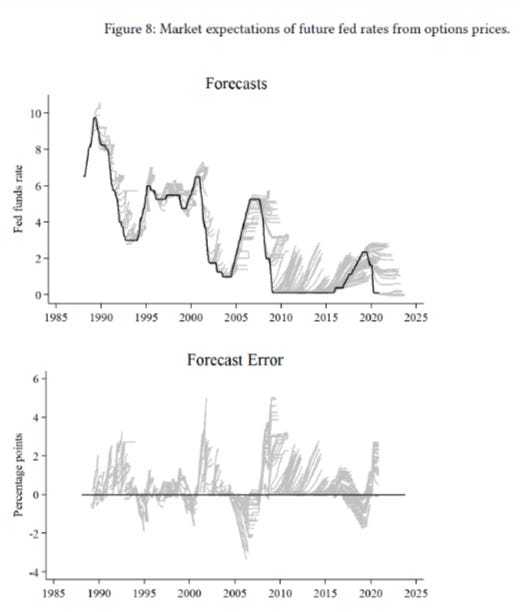

Recall from my earlier email “Piecing together the secular trends in macro-finance...” that for many years we've not been able to predict the decline of r*.

The forecasting errors on interest rates tend to be one-directional – to overestimate how high interest rates will go and end up seeing interest rates actually go much lower.

The charts below show huge forecasting errors from both the central banks and the market professionals. Remember, the central bankers set the rates themselves, and even so they're not able to predict the long-term decline! Everyone's systemically underestimating some underlying force that turns out to be more dominant than predicted.

The saga of inflation is to be continued…

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!

If you can’t find my emails in your inbox, please check your spam folder and in the “Promotions” tab for your Gmail. You may mark this email address “tigergao@substack.com” as “not spam” or “trusted sender” in your settings. Please feel free to let me know if you still have trouble receiving my emails.