George Soros: markets are always wrong...

Soros's wisdom on "reflexivity" and boom/bust cycles. Any sign of Fed policy change could cause a dramatic downturn in markets. Rising inflation could be 2021's biggest Black Swan...

I just started reading George Soros’s The Alchemy of Finance. He upended many of the old paradigms in understanding finance, and I highly recommend you to read the Introduction for the book, which has many philosophical arguments beyond finance and is free to read on Google Books here.

Soros’s writing on the boom/bust cycle of financial markets compels me to reflect where we are in our “young bull market” today – a central narrative that few deviate from. Here’s a quick summary of Soros’s ideas and possible connections to today.

Punchline: The bar for what could trigger a downturn may have been lower than ever, not because of the fragility of our fundamental economy per se, but because today’s boom is almost entirely supported by narratives. As long as there is any sign that people (the Fed, investors, politicians) are deviating from the central narrative that markets will continue to go up, that sign itself would likely be sufficient enough to bring down the whole market.

The theory of “reflexivity”

Soros is best known for his idea of “reflexivity,” which he defines to be a feedback loop in which human perceptions affect reality, which in turn influences human perceptions:

The concept of reflexivity is very simple. In situations that have thinking participants, there is a two-way interaction between the participants’ thinking and the situation in which they participate. On the one hand, participants seek to understand reality; on the other, they seek to bring about a desired outcome…

The two functions can interfere with each other by rendering what is supposed to be given, contingent. I call the interference between the two functions ‘reflexivity.’ I envision reflexivity as a feedback loop between the participants’ understanding and the situation in which they participate…

Reflexivity renders the participants’ understanding imperfect and ensures that their actions will have unintended consequences (p.2).

This is more than just saying that markets are shaped by human expectations, but going a step further in claiming that markets are inherently unknowable, and the “knowledge” we use to understand the financial world is already shaped by our worldview in the first place.

This circular logic (and tautology) is what distinguishes financial and social institutions from the the “hard” sciences – natural science or mathematical facts don’t change based on our perceptions; but finance, religion, and politics are fundamentally shaped by human perceptions and expectations in the real time.

The self-reinforcing boom/bust cycle

The phenomenon of reflexivity thus give rise to the boom/bust cycle, in which markets and human perceptions reinforce themselves. We believe the prices will be higher, so we push the prices higher, which validates our previous judgment that prices will go higher, and so on:

I contend that financial markets are always wrong in the sense that they operate with a prevailing bias, but the biase can actually validate itself by influencing not only market prices but also the so-called fundamentals that market prices are supposed to reflect.

In fact, markets are almost always wrong but their bias is validated during both the self-fulfilling and the self-defeating phases of boom/bust sequences. Only at inflection points is the prevailing bias proven wrong (p.5).

Eventually, the market would reach a turning point, which will reveal to the world that your entire thesis was wrong and put an end to the self-reinforcing loop:

Eventually, a turning point was reached. In the conglomerate boom it came when Sol Steinberg was unsuccessful in taking over Chemical Bank. In the technology boom the critical event was the auctioning of 3G licenses in Europe. Telecom companies were obliged to make inflated bids in order to justify their inflated stock prices (p.30).

In the case of the Enron scandal that ended that era’s stock market boom:

Enron, like many companies, used special purpose entities (SPEs) to keep debts off its balance sheets. But unlike many other companies, it used its own stock to guarantee the debt of its SPEs. When the price of Enron fell, the scheme unraveled, exposing a number of other financial misdeeds the company had committed. The Enron bankruptcy reinforced the downtrend in the stock market, which led to further bankruptcies and news of further coporate and individual misdeeds. Both the downtrend and the clamor for corrective action gathered momentum in a self-reinforcing fashion – just as the boom/bust model envisions (p.30-31).

The turning point for today’s pandemic bull market

The takeaway from the paragraphs above isn’t just about the boom/bust cycle itself, but rather the nature of the inflection point. Sure, markets fall when “the bubble bursts,” but the bubble is burst not by the worsening of fundamentals per se but by some random Black Swan event that finally shows everything is a House of Cards.

Such an event, unfortunately, is by nature unpredictable. What puts an end to today’s bull market could well be some whistleblower revealing a company’s fraudulent accounting standards that will eventually bring down a whole industry’s valuation and subsequently the stock market. Or, it could be the Fed suddenly raising interest rates or signaling that it will no longer support the market upwards… We don’t know what will trigger the next downturn.

Everyone knows the markets are overpriced right now, so the question is: How much long can the party keep going? The bull market during this pandemic recession has been almost completely driven by the Federal Reserve’s policy, so everyone’s looking at the Fed – the party can keep going as long as the Fed is still willing to support the market no matter what, and the party will end when the Fed doesn’t want to do so anymore.

I have previously written about the second-order nature of market exuberance, namely that markets will keep going up because very few deviate from the central narrative that markets will continue to go up. What I didn’t recognize is: as long as there is any sign that people (the Fed, investors, politicians) are deviating from the central narrative, that sign itself would likely be sufficient enough to bring down the whole market.

The bar for what could trigger a downturn may have been lower than ever, not because of the fragility of our fundamental economy per se, but because today’s boom is almost entirely supported by narratives.

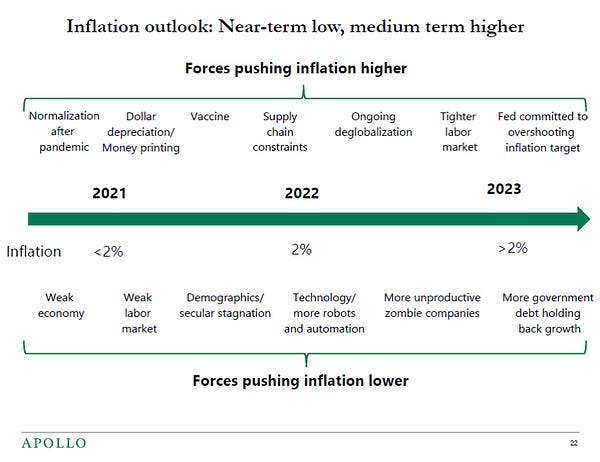

The Fed has indicated right now this is the new normal: low interest rate until at least 2023, no sign of inflation until 2022, high government debt that is now considered politically and fiscally acceptable, etc.

Because the Fed has been so steadfast in its current policy stances (repeatedly saying that they will NOT raise interest rates anytime soon along with other announcements), any tiny bit of sign that indicates a change in the Fed’s stance could cause a dramatic downturn in the markets and will lead to a self-reinforcing bust driving the entire market down. The Fed’s commitment for holding the economy together has been so unwavering, and it has been so confident in its forecasts for inflation and other macroecoonomic indicators, such that little room for error or change would be tolerated.

That is why everyone has their eyes on inflation, because that will likely be the metric that the Fed uses to judge when they should exit the current policy regime. We wrote a three-part essay about 2021 inflation outlook and why we’re not seeing broad-based inflation yet. But this could change out of the blue, as unlikely as it may seem now. The biggest Black Swan in 2021, therefore, is if we suddenly find that inflation is coming, though by nature it will be impossible to precisely predict how exactly it will happen if it does.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!