Larry Summers isn't all right – 8 reasons to NOT worry about inflation...

I'm not fully in Larry Summer's camp... Fiscal stimulus might not work that magically; inflation is a slow process; plenty downside risks to recovery; secular forces will push inflation down...

In my last email “Larry Summers isn't all wrong – inflation expectations could become unanchored...”, I talked about how we should plot out a clear exit strategy for the current fiscal expansion so that people don’t just expect unlimited money and inflation expectations don't become unanchored.

The consensus amongst most economists today is that we will see some form of inflation in 2021 (likely above 2%) because of the recovery and stimulus, but that inflation will be transitory. Larry Summers is one of few people on the opposite side, and I do think he makes some really good arguments why persistent inflation could be coming. Let me briefly chart out Summers’s arguments and explain why I am nevertheless not fully convinced by him…

Larry Summers is not against spending

Summers believes that we’re seeing the “least responsible macroeconomic policy” and heading for the “worst inflation risks in 40 years.” In case you don’t know Summers very well – he’s not a Republican… He is in fact one of the major proponent of the “secular stagnation” theory, and he has stated repeatedly that we need strong fiscal stimulus to get us out of Covid and secular stagnation.

However, he believes that the $1.9 trillion package is not necessary when the economy is recovering strong, and a better alternative would be focused on meeting necessary relief needs, focused on public investment needs, and with contingency triggers if the economy were to turn down.

He thinks that the Democrats are trying to get everything through this bill, whereas the more responsible choice would be to pass for a smaller package now, and then have a bigger infrastructure & public investments plan later that is spread out across many years. That will make sure we don’t see rampant inflation soon but also have the proper investments needed to get us out of economic stagnation in the long run. This is why he’s a big supporter of Biden’s infrastructure plan that was just revealed this week and a proponent of raising taxes for the rich & corporations.

So, Summers is not against spending or more progressive economic policies; he’s just against spending $1.9 trillion now… I don’t think he’s being unreasonable here.

Larry Summers is very worried about inflation

Summers projects three possibilities to unfold after this $1.9 trillion stimulus:

1/3 chance that inflation will significantly accelerate in the next few years and we’ll end up in a stagflation situation, like what happened between 1966-69 where inflation went from the 1% range to 6% range;

1/3 chance that we won’t see inflation, but that’s only because the Fed hits the break on the party hard very early on, and that could cause markets to freak out and eventually drive us to a recession;

1/3 chance that we’ll get what the Fed and Treasury are hoping for, which is economic growth in a non-inflationary way or with moderate inflation, and this is the “safe landing” case.

He thinks that macroeconomic policy should be about managing risks, but now macro policies are the destablizing force that could potentially insert more risks to the system. Summers is voicing some very stern warnings here.

8 reasons against Larry Summers

When economists say they disagree with Summers these days, they’re mainly talking about the inflation part, and not really anyone is saying that Summers is being unreasonable with his alternative plan for investing in America. In other words, it seems that the disagreement is more on technicality of the possibility of overheating the economy, rather than the morality/necessity of stimulating the economy. That’s an important caveat to note.

But anyways, here’s a list of reasons I’ve come across in the last few weeks about why we should NOT worry about overheating the economy, i.e. why persistent inflation isn’t coming anytime soon:

Still a lot of slack in the economy. The Congressional Budget Office (CBO) estimates that the current output gap is around 3%, which is a lot less than the 9% GDP that is the $1.9tr stimulus plan. But most economists seem to agree that CBO is likely underestimating the gap. For one, we are still around 10 million jobs short compared to the pre-pandemic level.

Inflation expectations are still fairly well anchored. Even though we will possibly overshoot inflation, it won’t be too persistent because people still recognize that this $1.9 trillion package is a one-time thing. The Fed still has a lot of credibility amongst market participants (well, maybe not that much, which I will talk about later, but still a good amount for now).

Fiscal stimulus might not last as long as you think. Yes, I have warned that there’s the possibility that people expect the Biden administration to rain down unlimited stimulus, but that is very unlikely to actually happen given political uncertainties in 2022 and beyond. In 2021 and early 2022 we will see strong growth, but by late 2022, the sugarhigh from the $1.9 trillion package would likely wear off, and if we don’t see more long-term plans passing, and if fiscal policy becomes less expansionary, the secular stagnation forces might actually make our growth slightly negative in 2022 and beyond. That is actually something to worry about.

People’s spending out of the $1.9 trillion package won’t be that high. First, a lot of pent-up saving is owned by middle and upper-income households, which have a much lower marginal propensity to consumer (MPC). As to the $1400 checks, low-income households could spend 60-70% of that, but the rich might only spend 3-4%. Most Wall Street investment banks estimate that on average only around 20-30% of that pent up savings will go into the real economy. In other words, most of the savings and stimulus payments will be saved, used to pay down debt, or buy stocks & Bitcoin (Wall Street also estimates that as much as 30% of these checks could flow into the stock market & financial assets like Bitcoin in coming months). Meanwhile, local governmetnts will finally be “bailed out,” and they’re not going to immediately spend all this stimulus/relief.

Inflation is a slow moving process, so there should be plenty time for the Fed to react. If we look at the rampant inflation that took place in the 1980s, it took around 15 years to get 10% inflation, and started with the Vietnam War. So even if we're headed in that direction, we will not see it in 2023 or anytime soon for that matter.

We just don't really know how inflation works… The predominant framework on forecasting inflation and overheating the economy is still the Phillips Curve, (which I’ve written about extensively here and here). Sure, the Fed may have preemptively tightened too early in 2015 when they thought inflation was coming but it actually didn’t, but we still don’t really know what the natural rate of unemployment should be. Did we not see inflation last cycle because the Phillips Curve is really flat, or did we not see inflation because the full unemployment rate was actually lower than the Fed thought? In other words, because we don’t know if the full employment rate is 3%, 3.5%, or 4%, it’s hard to tell whether we’ve really overheated the economy... Summers is worried about inflation, but when will we have actually overheated the economy?

Growth might not be as strong as well forecast it to be. Europe is not doing so well in terms of vaccination; new virus strains; supply chains disruptions, rising shipping costs & commodity prices, black swan events like the Suez Canal accident could all mean that the global recovery might not be that strong, and prices won’t rise back as quickly as we forecast them to be… There are plenty of downside risks in general that could hamper inflation.

Ignore the noises; focus on the secular trend. If you listen to Bloomberg & CNBC every morning while lifting in the gym like me (yes I lift bro), you’ll hear all kinds of commentators talking about all kinds of anecdotes: “Oh the companies I’ve been speaking to tell me that they’re experiencing a lot of supply-side frictions, and I just think we will see higher-than-expected inflation in late 2021…” blah blah… I’m sure a lot of these insights are good, but I wouldn’t overweight these concerns. These are strong secular forces that are pushing down inflation – technological innovations; globalization pushing wages down; aging populations; Larry Summer’s own theory of secular stagnation… These forces are arguably much stronger headwinds after we come out of this global pandemic. To me, the biggest challenge remains to be how we can stimulate the economy for more equitable growth, rather than dramatic overheating.

If you’d like to know the statistics, detailed analysis, or representative authorities/experts behind each of the above arguments, please let me know.

By the way, on the point that “inflation is a slow-moving process” – Summers thinks that assessment is flat-out wrong because the 1966-69 period saw a 4%+ inflation within 3 years because of Lyndon B. Johnson’s “Guns and Butter” fiscal expansion that was actually smaller than today’s scale, and that inflationary period happened before there was any supply shock, i.e. the oil crisis later in the 70s.

Summers also thinks it’s ridiculous for anyone to make the following two claims simultaneously: 1) inflation expectations are anchored; 2) the neoliberal era is over and we’re entering a new era fueled by fiscal stimulus. If we’re in a new era of progressive economic policy, then people would reorient their expectations, and then their inflation expectations would no longer be anchored!

Not a bad counter-argument. Maybe we’ll address this in another email.

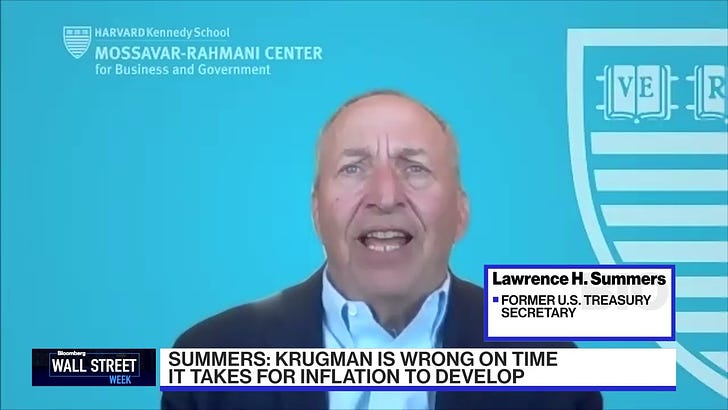

Short Bloomberg interview with Larry Summers that succinctly captures why he thinks persistent inflation is coming:

Long debate between Larry Summers & Paul Krugman that can give you a more in-depth look on this topic:

The saga of inflation is to be continued…

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!

If you can’t find my emails in your inbox, please check your spam folder and in the “Promotions” tab for your Gmail. You may mark this email address “tigergao@substack.com” as “not spam” or “trusted sender” in your settings. Please feel free to let me know if you still have trouble receiving my emails.