It was all fun & games until GameStop...

Reddit "mob" literally guillotined a hedge fund. A rational investor should understand that assets today are bound to be greater than their fundamentals because of the narratives surrounding them...

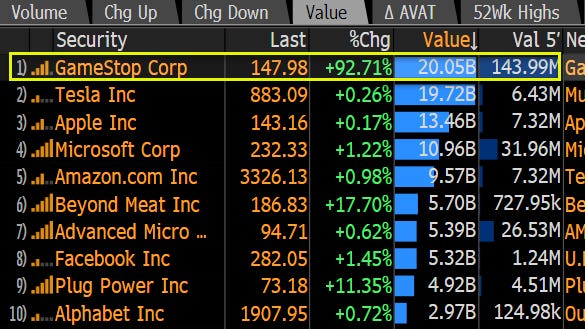

Alright let’s talk about it – the biggest financial story of this week if not this year so far, GameStop. In case you still haven’t heard about it: GameStop, the video game retailer, is having a wild ride in the markets. It closed on Friday at $65.01, opened Monday at $96.73, got as high as $159.18, as low as $61.13, and closed at $76.79. On Tuesday it opened at $88.28, closed at $145.96, and traded to ~$210 after hours.

Many of you started asking my thoughts on it on Monday, and I wasn’t paying too much attention. By Tuesday afternoon I was at an economics conference on the topic of low interest rates hosted by Princeton’s Griswold Center, and Mitch Julis (billionaire hedge fund manager of Canyon Partners) was talking about how the hedge fund shorting GameStop is now under attack by the Reddit/Robinhood traders. The panel of central bankers and Wall Street chief economists followed up with more thoughts on the incident. This is when I realized it’s no longer just fun & games anymore…

Bloomberg’s Matt Levine wrote a fantastic overview of what happened with GameStop, which you can read here. I will not repeat the whole tale and will just supplement some stories/analysis that he didn’t touch on.

The Reddit mob literally made a hedge fund go under

The incident mentioned by Mr. Julis of “hedge fund under attack” is Melvin Capital Management. The hedge fund started the year with $12.5 billion in assets and lost almost 30% through last Friday because it was hard-hit by a series of short bets, including GameStop. Melvin is a good fund. It has a wonderful track record of capital infusion into quality businesses, but now because of this incident it now needs a bailout.

There are two technical details that deserve clarification. The first is “short squeeze.” When you short a stock, you borrow shares of the stock that you believe will drop in price in order to buy them after they fall. If you’re right, you then return the shares to the lender, and your profit is the difference between your initial shorting price and then final sale price. However, the short-seller must keep paying interests for the borrowed shares, so if you’re wrong, not only do you lose money, you’d also have to keep making interest payments in order for your bet to go on. Especially if a stock’s price jumps sharply higher like GameStop, it would force short-sellers to buy more of the stock to forestall losses while continue to make the interest payments in order for their bet to go on – hence being squeezed out of their current positions.

This is what happened to Melvin – the fund was short squeezed because the Reddit investors have essentially declared war with Melvin and are determined to keep driving up the prices until Melvin dries up. Reddit users are literally applauding each other for buying the GameStop stock at ever higher prices. A rally cry on r/wallstreet bets says: “we can remain retarded for longer than they can stay solvent!”

Most sensible people know that GameStop is not worth its current valuation and the stock will eventually drop to single-digits, but what day will that day be? Will it be two days from now or two months? The mechanism of short squeeze means that it doesn’t matter whether you’re right eventually in the long run; it only matters whether you can survive until the day the stock falls off the cliff. When GameStop returns to its fair valuation, Melvin might be long dead. This is why they’re getting an emergency $2.75 billion bailout from Citadel LLC and Point72 Asset Management, which can hopefully last them to the day that their short-sell thesis is proven correct.

Melvin can never beat the Reddit mob, by construction

But there’s another important technical detail not mentioned in most reports, which is that investors in hedge funds (like pension funds or university endowments) can withdraw money from hedge funds anytime they want (unlike for private equity funds there is a multi-year lockup period where investors can’t pull their committed capital). So, if Melvin’s investors saw the fund just lost 30% of its valuation, they could demand to pull their investment. Melvin is thus being squeezed on both fronts – by the Reddit investors and by their investors.

By construction, a hedge fund is much more suspectible to market volatility than other financial institutions like venture capital funds or investment banks (well, that’s why they’re called hedge funds). So the balance sheets of a hedge fund like Melvin are very susceptible to exogenous shocks like sudden & sharp rises in stock prices and are not suitable to engage in such a trench warfare with the retail investors in the first place.

The Reddit crowd found the perfect opponent and striked its most vulnerable place at the perfect moment.

Unite your comrades, drive up stock prices, and everyone makes money

It’s just an amazing story how the Reddit mob literally just folded a hedge fund, seriously.

What we saw from the GameStop stock is that one can literally drive up/spoof stock prices if one owns a popular Reddit page or YouTube channel that has some major sway over a group of retail investors. You don’t need to do any fundamental analysis per se (though some on Reddit have posted very “legitimate” reasons why the fundamentals of GameStop can actually support a $700/share stock price).

All you need is to create an interesting narrative – like Tesla is solving climate change; Bitcoin is the new gold; GameStop is the poletariat uprising that will stick a middle finger to CNBC and all the “professional investors” who have been making fun of us retail investors…

Who needs institutional investors to go in and drive up stock prices when you can be a man of the people?! No joke. Seriously, we all know the rise of Robinhood day traders, so somone’s gotta lead them, right? If they can get united and concentrate their capital into manipulating prices of small-cap stocks, everyone will make a lot of money.

The death of fundamentals investing?

It’s hard to say that this would upend any existing paradigms, but big-league investors should seriously rethink their relationship with retail investors and narratives at large.

If you’re a sharp, rational investor, you likely understand that the fundamentals of Tesla, Bitcoin, and GameStop cannot support their valuation. However, if you’re truly sharp and rational, you should also understand that these assets are bound to be greater than their fundamentals would make them seem to be because of the narratives surrounding them.

I don’t think what happened over the past year signals the death of fundamentals investing per se, but it does prove once again that the kind of investing only looking at fundamentals is highly inadequate in today’s market environment. Melvin is correct that GameStop is a bad company; but it’s wrong that the stock price won’t go up indefinitely.

We also see this in politics, media, academia, and almost all fields that are not hard sciences – narratives are playing a bigger role in shaping what truths are and could be, and the citizenry is organizing themselves in magical ways to upend old paradigms once dominated by the elites.

The revolt of the public

If you’re curious what the Reddit investors are saying about those in power, here’s a good Twitter thread to read:

We’re not just in a young bull market; we’re in a young bull market led by the poletariats… (at least it appears so in the last couple of days). And if politics taught us anything, it’s that you really shouldn’t fight against the “mob” when they’re just getting fired up about something.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!