I'm raising a SPAC for Policy Punchline...

This is your opportunity to break free from your traditional passive investing portfolio and finally be exposed to tech innovations. SPAC isn't all bubble; it's also optimism!

Yesterday I gave an overview of what SPACs are, how they’re different from the traditional IPO process and public market scrutiny, and the recent SPAC mania that is dramatically bigger than what we experienced in 2020.

In this email I want to explore some of the dominant narratives surrounding SPACs. If you’re convinced by them, perhaps you’d consider purchasing some shares of the SPAC I’m currently raising for Policy Punchline.

Policy Punchline SPAC at $100 million valuation?

Matt Levine is a Bloomberg columnist who writes a really popular daily financial newsletter, and Josh Wolfe is a famous VC investor who specializes in frontier tech. Wolfe wrote a funny tweet the other day joking about taking Levine’s newsletter private and using a SPAC to acquire Bloomberg:

The idea is not completely unfounded. Beacon Street Group, a collection of financial research and newsletter providers, is indeed going public via SPAC:

I think we can do the same thing for Policy Punchline. This is my thinking why we can hit $100 million in valuation:

We air twice a week; we don’t make any money now, but there are people who want to be interviewed by us because we have a good brand name and is affiliated with Princeton. We’ll sell some of these interview slots, while also bringing on some nutraceutical startups for ads.

That should get us to ~$200,000 per episode in revenue. I arrived at this figure because Joe Rogan makes ~$800,000 per episode, and I think we’re at least a quarter as good as Joe if not half as good…

This means a monthly recurring revenue of $1.6 million for us and a yearly revenue of $19.2 million.

We’ve had tons of prestigious guests on our show; I’ll email some over the weekend to ask them to join our board or be our promoter. We give them 2% of the equity which is not that much, but their presence will boost our brand and probably double our valuation.

Lastly, we’re technically a university non-profit organization so we probably get some tax benefits. We also have some valuable intangible assets (our brilliant team members’ sharp minds).

Yada yada yada, I don’t know how podcasts are valued these days, but I think all this puts us at a $100 million valuation at the minimum no matter what multiple you use… I’m trying to be conservative with my baseline estimate here.

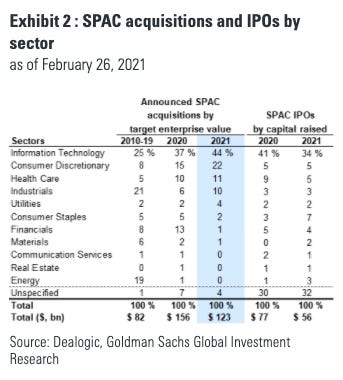

Data from Goldman Sachs show that there are currently 326 SPACs with $103 billion in capital currently searching for merger targets as of 2/26/2021. Let’s bump that number to 327 with “Policy Punchline Acquisition Corp.”

Why invest in my SPAC? The great de-coupling from passive investing

This is one pro-SPAC narrative that I heard from VC investor Howard Lindzon:

The rise of mutual funds and index funds over the last few decades means that every American essentially has the same portfolio these days. We’re constantly told that we should just passively invest and track the broader market.

But with SPACs, whose shares one can buy and trade in the public markets, retail investors can finally break through their boring passive investing strategy and be involved in the great tech boom. You can finally buy some true innovations instead of just owning Wells Fargo and Verizon in your portfolio like Vanguard tells you to!

This is the “great de-coupling” from passive investing.

There is something inherently attractive about this kind of “populist,” “anti-establishment” narrative, like many other populist narratives in finance we recently heard. If Robinhood is democratizing access to stock trading, then SPACs are democratizing access to the great technological innovation.

It used to be a “rigged game” that VC and private equity funds would get to invest in tech companies long before they’re public, and hedge funds and institutional investors subscribe shares and enjoy the IPO price pop long before retail investors can get involved. But with SPAC, you can be in on the action alongside the great American entrepreneurs!

The SPAC bubble isn’t all bubble; it’s also optimism!

I don’t think there’s anything immediately wrong or off about the narrative above. To me, SPACs are a reflection that new technological innovations are becoming more important in todays’ society.

Is SPAC a bubble or mania? Sure. Is the bubble partly driven by the low interest rate environment and easy monetary policy that the Federal Reserve has created? Sure. But underlying all these froth, there is still a foundational sense of optimism that so much would need to be built and innovated in the next few decades. Everyone’s talking about electric vehicles, renewables, gene therapy and treatment, healthcare services, etc. etc.

People do recognize the value of investing in tech, and the bubble reflects some fundamental desire. Sure, it’s going a bit crazy right now, but I think the rise of SPACs is indicative of a societal awakening (or at least awakening within the tech & finance people) that tons of innovations will need to happen in order to get us out of the world’s current mess.

Do SPACs pose risks to retail investors and our financial system? Not really…

What we do know about today’s market environment is that many people are sitting with a lot of free cash – not just citizens with their pent-up savings, but large institutional investors who have been saving up dry powder to invest. Deutsche Bank’s Jim Reid recently said in an email that:

if equity markets remain strong, history tells us that in cycles like this, we’re going to see SPACs and PE pay some very rich valuations for very big deals over the next two years. Furthermore, the phenomenon may add a ‘takeover premium’ to the whole market as SPACs begin to make acquisitions. That sounds like a massive risk to the financial system, but it may not be.

Unlike the M&A craze of the 1980s where public companies were among the big acquirers, SPAC and PE investors are a relatively narrow group of individuals or asset managers with niche strategies. That means the pain, if the SPAC bubble bursts, should be felt primarily by people who have more capacity to absorb the losses.

In other words – yes, the pro-SPAC people are trying to get more average Americans to invest in SPACs, but if you really look into the details, it’s still a really small niche. Most money in the SPAC space is from institutional investors who can bear the losses fairly comfortably if the bubble bursts. Even if retail investors put money in the SPAC market, few are putting in their life savings.

As a framework, it’s worth saying repeatedly that not all credits are created equal. Household credit boom vs. private credit boom vs. government credit boom could all lead to very different outcomes for the economy, for example. Pouring money into a few SPACs is very, very different from into subprime mortgages and the housing market. Yes, we should be wary of this “SPAC mania,” but it doesn’t seem to be that big of a deal like what we saw before.

What has been historically interesting is that even if there’s a big bubble, so long as the capital is being devoted to something useful, it might still lead to a net positive benefit for the society even after the bubble bursts, like what we saw in the dot com bubble that did fuel the rise of the Internet economy. This has been argued by many, including legendary VC investor Bill Janeway on our show.

The cynical view about SPAC

I did hint at my last overview email that SPACs may have the potential to lend wild-dream unicorns a way out (well, this is arguable and just my personal opinion). Think about it – since SPACs are all about looking ahead and having a famous promoter (like Chamath or Bill Ackman) telling the public market how great your company is, it allows the private company to tell its BS story unrestricted. Now, instead of having to convince the broader public markets that you’re actually profitable, WeWork just needs to fool one SPAC. Hell, SoftBank could’ve probably created its own SPAC and take WeWork public with that, idk…

The less cynical view is that because SPACs' private negotiations allow the management and investors to control the “going-public process” in a more flexible and faster way, it is a good alternative to the current IPO ecosystem that is guarded by investment banks that will rip you off with that fat fee as you go public.

The more cynical view is that SPACs, rather than being the amazing alternative, is simply a way to take the private-market BS to public markets. If you’re a wild-dream unicorn that struggles to convince public investors of your profitability, you can still find a way to IPO. Likewise, if you’re a super boring company that doesn’t capture anyone’s imagination (meaning that no legitimate company wants to buy you and you cannot go public through traditional routes), you can now simply find some SPAC that can take you public… This is the worst of both worlds.

SPAC is interesting because for those wild-dream unicorn companies, you give them a way to avoid public markets; and for the underwhelming companies, you also give them a way to avoid public markets…

In other words, SPACs don’t fuel innovations; they just allow the second- and third-tier companies to pretend that they’re innovations and get cheap capital. This is the cynical/pessimistic way of looking at this SPAC boom, I suppose.

The saga of SPAC is to be continued…

Disclaimer: Needless to say, my emails are just casual commentaries. I try my best to write them thoughtfully and with care to provide some alternative perspectives on various issues, but please do not treat them in any way as financial advice for your own investment.

As always, please let me know your thoughts. You may leave a public comment, or privately respond to this email which will carry your words directly to my personal inbox.

If you like my emails, I would appreciate if you could tell your friends and family about it!

If you can’t find my emails in your inbox, please check your spam folder and in the “Promotions” tab for your Gmail. You may mark this email address “tigergao@substack.com” as “not spam” or “trusted sender” in your settings. Please feel free to let me know if you still have trouble receiving my emails.

Good post! It led me to question, how can we as writers and intellectuals be more transparent in the array of sources we integrate into our own perspectives? For instance, is there an easy way to measure how diverse the building blocks of someone's wordview are? Maybe you could measure the degree to which papers cited cite each other, and rate those as either friendly or antagonistic citations, and that would give you a pretty good idea of how one sided or multi-faceted someone's analysis is. Hard to do without a single citation system though. Maybe this presents an opportunity to add value?

Hi Tiger, Good to see you diversifying like you describe. I recommend Steve Sailer's blog, which specializes in important political and social issues arising out of often suppressed realities of human biodiversity. His is 20 year old full-time blog financed entirely by voluntary contributions from his many readers. If there is another blogger who makes his living that way I haven't heard about him or her (not counting the new substack phenomenon)